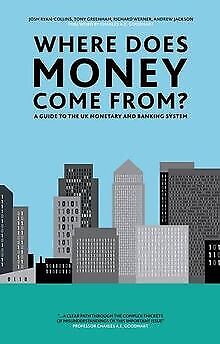

Where Does Money Come From? A guide to the UK monetary and banking system

Josh Ryan-Collins, Tony Greenham, Richard Werner and Andrew Jackson.

2011

With all the talk about the dollar’s demise, Central Bank Digital Currencies (CBDC), cryptocurrencies and the rise of the Yuan, we need to ask, what is money and where does it come from?

The authors explain in the opening chapter the misconceptions about money creation, where many think the government creates money via bank deposits. Richard Warner even carried out an empirical experiment in Germany with the public of where money comes from. The authors deal with these misconceptions in the opening chapters by debunking the popular conception of banks as financial intermediaries and custodians and critique the textbook ‘money multiplier’ model of credit creation and provide an accurate description of the money creation process.

Their answer, as explained by Ryan-Collins, Greenham, Werner and Jackson is outrageously simple; your bank creates money out of thin air. The Bank of England says this openly now too: “In the modern economy, most money takes the form of bank deposits. But how those bank deposits are created is often misunderstood: the principal way is through commercial banks making loans. Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.”[1]

Further, according to The Bank of England “By far the largest role in creating broad money is played by the banking sector…when banks make loans they create additional deposits for those that have borrowed”, yet this little known fact remains contrary to public perception. Private banks have monopolised the creation and allocation of money in most modern economies, including the UK’s. This simple fact has been consistently ignored by policy makers and economists in all those banking reforms proposed and implemented since the financial crisis in 2008

Based on detailed research and consultation with experts, including the Bank of England, this book reviews theoretical and historical debates on the nature of money and banking and explains the role of the central bank, the Government and the European Union.

According to the Bank of England, about 3% of money in the UK is “base” money, i.e. notes and coins, and reserves electronically created by the Bank of England. The other 97% is credit created by commercial banks. We treat this bank-created money exactly as if it was notes and coins, except that debit cards and internet banking make it much more convenient to transfer than physical money.

The book makes it very clear in simple and straightforward language that banks are central to the money creation process and therefore at the heart of the economy, economic growth, productivity and development. The authors spend a whole chapter looking at the history of money and banking from ancient times to more modern times, from commodity money to what we have today of credit money.

“Where does money come from?” is smart, clear, relatively short and just repetitive enough to make you understand the relevant concepts. Some of their findings will shock you, but that is due to the many misconceptions that exist.

If you still can’t get your head around how banks create money out of thin air, Richard Warner carried out an empirical experiment, the first in the 5,000 year history of banking, on the question of whether banks create money out of nothing.