Vladimir Putin, the Iron Man of Russia in a pre-dawn TV address on the 24th of February, declared that his nation could not feel safe and immediately launched the invasion of Ukraine. The West, looking on in horror, have ruled out any direct NATO military intervention and have started the economic war by targeting Russia’s economy, financial institutions and prominent business individuals by launching a broad range of sanctions. These include banning the export of specific oil refinery technologies to freezing the assets of Russian financial institutions and specific individuals including Putin himself. But, perhaps the most powerful sanction on Russia is the decision to deny specific banks access to the SWIFT system, a worldwide financial messaging system.

SWIFT is “The Society for Worldwide Interbank Financial Telecommunication.” It is a vast messaging network that sends and receives money transfer instructions accurately and securely among its users. It was founded in 1973 and headquartered in Brussels, Belgium, though its first and major data centre is based in Virginia, USA. SWIFT actually does not hold any payment facility or cash, it is not a payment system. Rather, it is a platform to transfer message instructions of payments which amount to 42 million messages a day with payment instructions in the region of $5 trillion a day.

So, how does SWIFT work?

Consider the following example. In my profession I am a regular user of the SWIFT system. When I need to pay one of my crude oil suppliers, I instruct Eastern Bank Limited in Dhaka, Bangladesh with whom my company has a bank account to send payment to my supplier’s Wells Fargo Bank in New York, USA. Eastern Bank will click on their computers, which will send a money transfer instruction to Wells Fargo through SWIFT utilising the SWIFT reference numbers and ISBN codes. Wells Fargo will click on their internal computers which will credit their digital ledgers and debit Eastern Banks ledgers, leading to the payment.

From Telex to Computers

Before the advent of SWIFT, the world’s financial institutions depended on telex machines. Banks wrote long instructions of telex messages which were prone to error. If a bank’s address was missed out or incorrect, then this error led to failure of payment. In this system, a cross-border transaction would often require the exchange of more than ten Telex messages, which made the process costly and time consuming. Today SWIFT provides every user with unique code (SWIFT Code) and has a dedicated set of message types (MT). That’s why now users don’t need to write long messages and there is a very low possibility of human error.

The origins of SWIFT lay in finding a solution to the immediate problems occupying banks in the 1960s; market access, transactional efficiency, human error, robustness and security. Today around 2,500 institutions with almost 12,000 users from more than 200 countries and territories use the SWIFT platform for cross border payments. The daily message exchanges in the SWIFT are nearly 42 million a day and growing.

Weaponizing SWIFT

From the beginning of the 21st century, a number of countries have used SWIFT as a financial weapon targeting countries and individuals across the globe. During America’s war on terror, its Office of Foreign Assets Control (OFAC) sanctioned many individuals who were placed on the block list of SWIFT networks.

As there were many Ahmads on the OFAC sanction list I found I was unable to pay many of my foreign machinery suppliers with a Letter of Credit (LC) as part of my name is Ahmed. I was required to prove I was none of the Ahmeds on the OFAC list and only then were payment instructions sent to my suppliers.

The first country to be denied access to SWIFT was Iran. When Iran was sanctioned by the US and its allies in Europe due to its nuclear program, it was also disconnected from SWIFT. In 2017, SWIFT revoked access for North Korean banks.

During Russia’s conquest of Crimea and Eastern Ukraine in 2015, the US and UK threatened Russia that it would be booted out of SWIFT, though following German objections, it was never implemented. On the 2nd of March 2022, against the backdrop of Russia’s invasion of Ukraine, the EU banned certain Russian banks from SWIFT along with the US, UK and Canada,[1] with the objective being to disrupt Russia’s ability to do business across borders.[2]

How Much Does a SWIFT ban hurt?

SWIFT is a vast network of financial institutions and provides the world with a robust system through which payment instructions can be completed with speed, efficiency and in a cost-effective way. This also means the world is highly integrated, revealing unintended consequences from sudden activity.

In Russia’s case seven banks have been banned from SWIFT and will therefore not have direct access to international markets. That means individuals and companies using those banks will have a harder time borrowing or investing money across national borders, receiving money for exports and paying for imports.

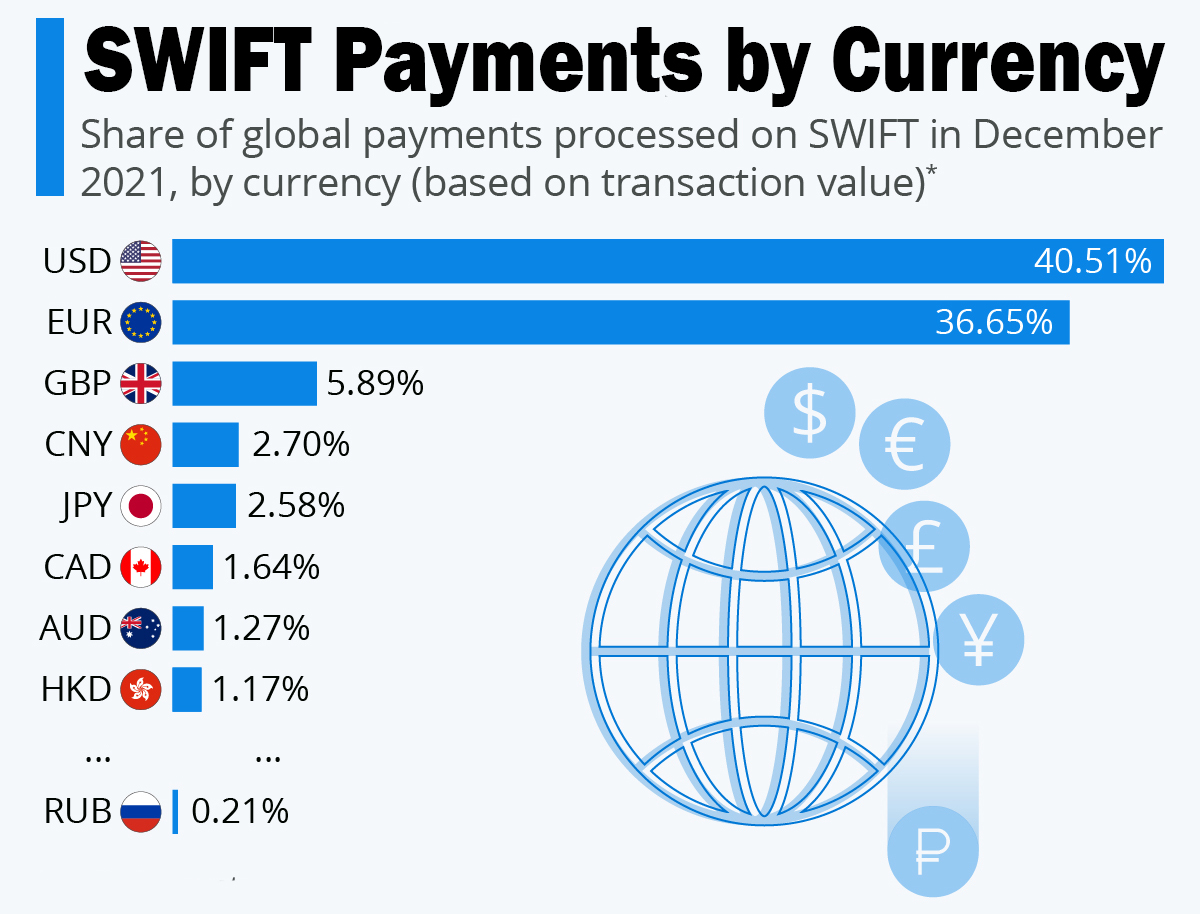

There are alternatives for these banks, they can use apps and email for the messaging but those will cost more and are insecure. Russia could use China’s Cross-Border Interbank Payment System (CIPS), however it is not robust like the SWIFT system and it settles transactions in Yuan, whose share of world payment transactions is only 3%.

When Iran was banned from SWIFT, it was unable to trade oil in dollars, losing half of its oil exports and 30% of its total foreign trade over the last 5 years. overtime. In addition, these bans also created problems for China as it is the world’s top energy buyer.

The SWIFT system gives the US a unique advantage. America’s domestic currency, the dollar, is used in 40% of payments as per SWIFT statistics meaning it can intervene and place bans on the use of its domestic currency on a world wide scale. US intelligence agencies have long been monitoring the SWIFT system. Der Spiegel reported in 2013 that the National Security Agency (NSA) widely monitors banking transactions via SWIFT. The NSA intercepts and retains data from the SWIFT network used by thousands of banks to securely send transaction information. SWIFT was named as a ‘target’, according to documents leaked by Edward Snowden. The documents revealed that the NSA spied on SWIFT using a variety of methods, including reading ‘SWIFT printer traffic from numerous banks.’[3]

Can SWIFT be Replaced?

Both Russia and China can see the dominant position of the US when it comes to global finance and both have stated they want to change the existing western dominated order, especially now that it’s being weaponized. Russia’s central bank launched its own version of SWIFT in 2018 called the: System for Transfer of Financial Messages (SPFS). Then in 2019 China also commissioned its own SWIFT, the Cross-Border Inter-Bank Payments System (CIPS).

Currently 38 banks from 9 countries are connected to Russia’s SPFS with almost 340 domestic users. 20% of Russia’s domestic payments go through this homegrown system. China’s CIPS system has 1288 participants covering 104 countries and regions around the world.[4] Neither system is as widespread as SWIFT and both are more costly, whilst Russia’s SPFS is not as secure as the other systems.

Some have touted cryptocurrency as an alternative to SWIFT. The advantage of cryptocurrencies is that they are of a decentralised nature where SWIFT is centralised. Countries such as North Korea use cryptocurrencies by employing hackers to steal other cryptocurrencies. North Korean hackers also threw SWIFT into an embarrassing position during a cyber heist in 2018 when they stole $101 million by undermining the SWIFT security system.[5]

For the moment these alternative payment messaging services are complementary rather than replacements for SWIFT. But with the US weaponizing SWIFT and now restricting a political power such as Russia this may very well push many consumers of hydrocarbons to join CIPS and SPFS.

Conclusions

SWIFT plays a key role in the global economy and whilst major countries like Russia and China are cowering for alternatives, SWIFT can not be displaced for the moment. Russian citizens will feel the pain from being banned from SWIFT as Russian companies will have to find other ways to pay for imports. That said, Russia has been building contingencies for some time and is well placed to weather this storm in the short term. As the EU imports around 45% of its natural gas from Russia, Russia does have this lever to use to its advantage. The cost of operating in the integrated global economy is when you fall out of favour, or, are independently minded, the global rules based order can be used by the creators of the system to contain and restrict you. Until a true alternative nation state emerges with its own systems and designs, western nations will always have the economic advantage over everyone else.

[2] What Are the New SWIFT Sanctions and Their Impact on Russia? | Time

[3] SPIEGEL Exclusive: NSA Spies on International Bank Transactions – DER SPIEGEL

[4] https://www.cips.com.cn/en/participants/participants_announcement/56547/index.html

[5] Inside the North Korean Hacking Operation Behind SWIFT Bank Attacks (darkreading.com)