The US dollar has been the dominant global currency for several decades now and has provided the US with a strategic tool that has paid dividends many times over. With the rise of China in the 21st century there is much talk about challenges to the dollar as the global reserve currency. In this two part geopolity series, we look at the history of the dollar’s rise and its current status and in part two we assess the challenges to the dollar and their prospects to replace its global position.

After WWII, Europe was destroyed and the US was the last man standing allowing her to define the terms of the postwar order. The Yalta Conference in 1945 distributed the spoils amongst the victors, but the year before at the Bretton Woods Conference the International Monetary Fund, the World Bank and the General Agreement on Taxes and Tariffs (GATT) were created. The Brookings institute confirmed in a report: “The United States has viewed all multilateral organisations including the World Bank, as instruments of foreign policy to be used in support of specific US aims and objectives…US views regarding how the world economy should be organised, how resources should be allocated and how investment decisions should be reached were enshrined in the Charter and the operational policies of the bank.”[1]

Having the world’s largest gold reserves at the time, the US reconstructed the global financial system around the dollar. The new system, created at Bretton Woods, tied the currencies of every country in the world to the US dollar through a fixed exchange rate. It tied the US dollar to gold at a fixed rate of $35 an ounce. This made the dollar as good as gold. The Bretton Woods system made the US dollar the world’s premier reserve currency. It effectively forced other countries to store dollars for international trade, or to exchange with the US government for gold. Being the issuer of the global reserve currency guaranteed international demand for the dollar. This meant the US could print dollars at will, an unlimited supply, since the wider world always needed dollars and would absorb the ensuing inflation.

With the Vietnam War dragging on for over a decade and the runaway spending, this resulted in the US printing more dollars than it could back with gold. By the late 1960s, the number of dollars circulating had drastically increased relative to the amount of gold backing them. This encouraged foreign countries to exchange their dollars for gold, draining the US gold supply. President Richard Nixon “temporarily” suspended the dollar’s convertibility into gold in 1971; the “temporary” suspension is still in effect today. Leaving the Gold standard eliminated the main reason for foreign countries to need large stocks of US dollars. The Nixon administration dealt with this with a series of agreements with Saudi Arabia from 1972 to 1974, creating the petrodollar and giving foreign countries another compelling reason to hold and use the dollar. This new arrangement preserved the dollar’s special status as the world’s top reserve currency. The agreement was for the US to prop-up the Saudi monarchy in return for the world’s largest oil producer, with the world’s largest oil reserves selling oil in dollars and using her dominant position in OPEC to ensure all oil transactions would only happen in US dollars.

Today the US dollar dominates global transactions, whether commodities, finance or payments. Oil dwarfs all other major commodity markets combined. In today’s modern world every nation needs oil, and as oil is priced in dollars every nation needs US dollars to buy oil. Today, when Britain buys oil or gas from Qatar, it has to purchase US dollars first on the foreign exchange market to pay for the oil.

International trade built on the dollar creates a huge artificial market for US dollars, and this is what sets apart the US dollar from every other purely local currency. The US dollar in effect acts as a lubricant or middleman in countless transactions amounting to over $7 trillion a day that have nothing to do with US products or services. In fact, 60% of foreign exchange contracts into the dollar have nothing to do with the US.

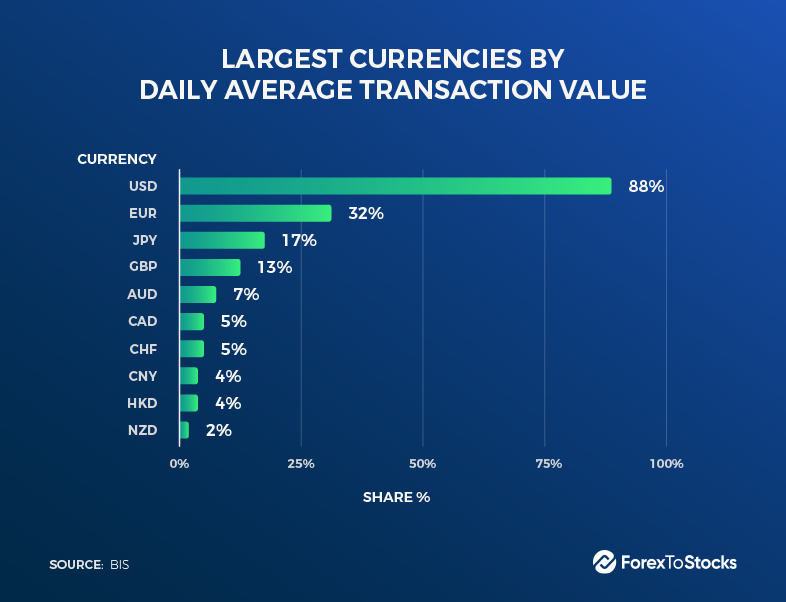

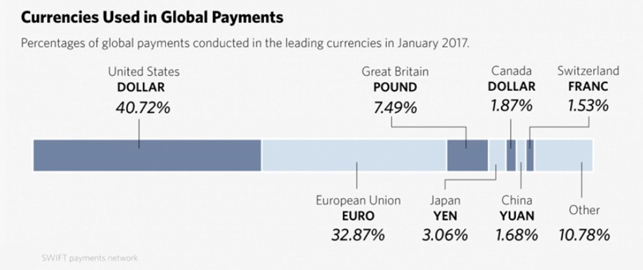

What the US achieved, by forcing oil to be priced in dollars and creating an enormous demand (dependency) for dollars, was to become a benchmark for international trade. As the entire world needs dollars for oil, this then forced them to also use dollars for international trade. In addition to nearly all oil sales, the US dollar is used for 88% of all international transactions. The SWIFT system that enables financial institutions to make payments on behalf of companies, governments and institutions is dominated by the US dollar. All nations globally have little choice but to take dollars in one way or another.

What the US achieved, by forcing oil to be priced in dollars and creating an enormous demand (dependency) for dollars, was to become a benchmark for international trade. As the entire world needs dollars for oil, this then forced them to also use dollars for international trade. In addition to nearly all oil sales, the US dollar is used for 88% of all international transactions. The SWIFT system that enables financial institutions to make payments on behalf of companies, governments and institutions is dominated by the US dollar. All nations globally have little choice but to take dollars in one way or another.

This gives the US unmatched geopolitical leverage. The US can sanction or exclude any country from the US dollar-based financial system at the flip of a switch. By extension, it can also cut off any country from the vast majority of international trade. This is how the US dealt with nations during the Cold war who attempted to join the Eastern bloc such as Cuba. After the fall of the Soviet Union both Iran and North Korea have faced sanctions and have been excluded from global commerce due to the US dominated global financial, monetary and economic system. Several European companies refused to fulfil their dealings with Iran for fear of America.

It requires no effort for the US to create dollars; they are literally printed out of thin air, or created on computer entries which can then be exchanged for real things like, Italian cars, electronics from South Korea, or Chinese manufactured goods. The US can also create lots of debt, in the form of treasuries, which the world will buy as it needs dollars.

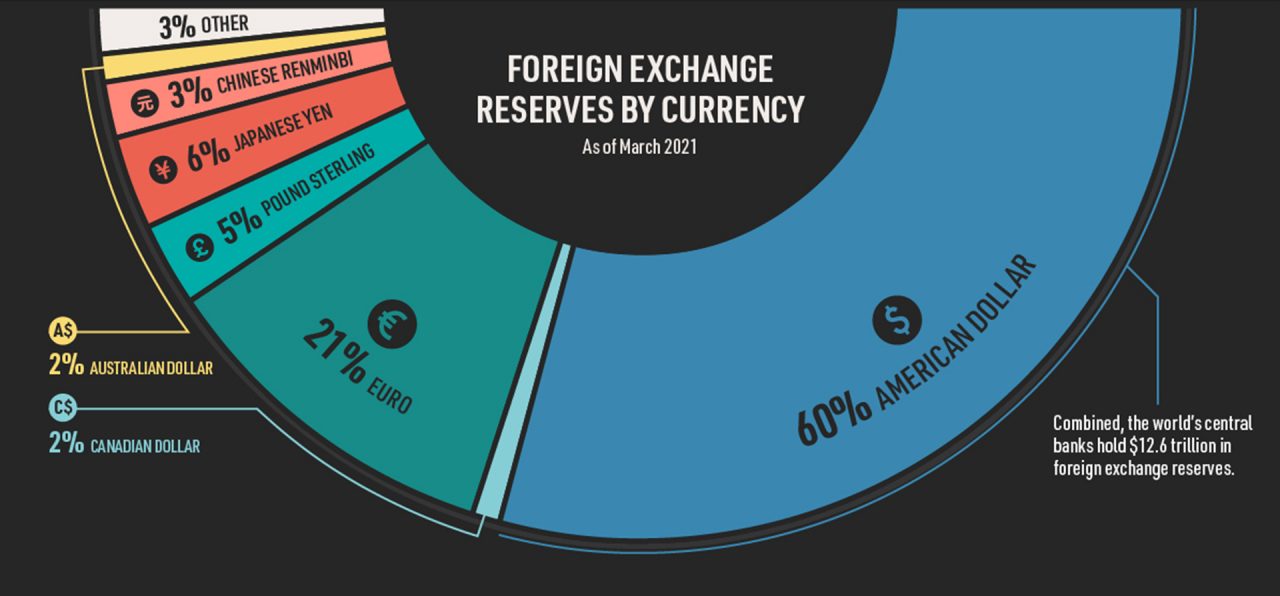

With most payments in the dollar, the dollar’s share in the reserves of 146 central banks worldwide is 64%. This significantly outweighs other currencies, with the euro occupying 20%, and both the Japanese yen and pound sterling occupying just 5%.

The US may have the F-35 and F-22, it may be developing laser weapons and hypersonic missiles, but her real weapon of mass destruction (WMD) is the dollar which at the click of a mouse can cut off a nation from the global financial system. It can do this easily as the dollar has been made the lubricant for global trade and finance. With no access to dollars a nation essentially becomes severely restricted internationally in terms of its trading, and with sanctions it then becomes isolated.

There continues to be much talk of the dollar’s demise and challenges to the dollar’s dominant position. These will be the subjects of part 2.

[1] Catherine Gwin, U.S. relations with the World Bank, 1945-1992, Published in 1994, (Brookings Occasional Papers) Brookings Institute

2 comments

Abu Pikachu

19th December 2021 at 2:07 pm

You write:

“..the US dollar is used for 88% of all international transactions.“

But in the figures you show later on, the US dollars amounts only to 40.72% of the currencies used in the global market. What am I missing here?

Adnan Khan

19th December 2021 at 4:08 pm

The SWIFT system is a payment system between banks, the dollar through this system is 40% of transactions.

All transactions globally, financial, services and non-SWIFT payments is even higher with the dollar.