By Arif Samad

Five years after the worst recession in recent US history, the US Commerce Department reported that GDP growth in the first quarter of 2014 contracted by nearly 3% . While unseasonal wintery weather has been blamed for the poor results, the failure of the US economy to sustain a health recovery 5 years after the financial crisis exposes fundamental flaws in the world’s largest economy. It further proves the growth that has been achieved has been stimulus driven and since the Federal Reserve began tapering Quantitative Easing (QE) the brakes have been slammed on growth. This underscores that the flaws in the US economy are structural – transcend the business cycle – and are related to 4 key factors.

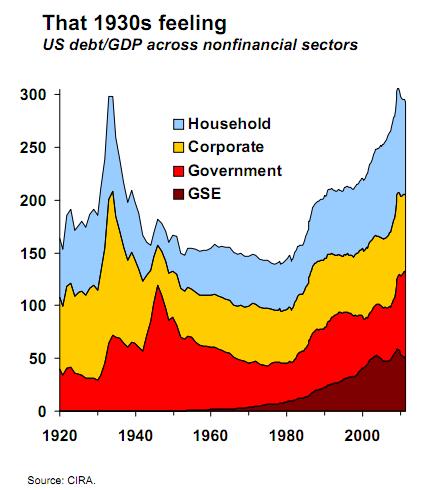

Firstly, the US national debt currently exceeds $17 trillion, about the same as the total value of goods and services produced (GDP) in America in a year. Add to this personal and business debt and the US debt mountain stands at around 280% of US GDP, according to McKinsey & Company 2012. This scale of debt cannot be cleared by a spurt of inflation or during the upside of the business cycle. The debt acts as a millstone holding back investment in the productive capacity of the economy which is critical for a sustained economic recovery. Servicing the debt is a burden on consumers who cut back spending and business who curtail investment. Both have a negative long term drag on the economy. Finally, the woes of US Government borrowing could hardly have been missed in recent months with national government shut down before Congress raised the debt ceiling yet again. The colossal overall debt burden means the nation is only a crisis away from bankruptcy.

Secondly, America’s decline in manufacturing is deepening the economic problems it will face. US manufacturing as measured by the number of jobs has declined by a third since 1998. This has had severe impacts on sectors and regions such as car manufacturing in Detroit at state level. At the national level the structural decline in US manufacturing has meant more trade imports and less exports. Constant trade deficits since the 1980s for an economy the size of the US have huge implications for the balance of payments from mounting future commitments on US Treasuries. At the same time, persistent net trade deficits are a constant drag on GDP growth. This economic disaster is compounded by the fact that US’s biggest trade deficit is with China a potential future foe which is also the largest foreign holder of US Treasuries.

Thirdly, America’s consumption driven growth is unsustainable. Consumption dominates US GDP accounting for over 60% . This is no coincidence since economic growth has persistently been skewed towards spending. US consumer led growth has been fuelled by debt (hence the huge size of US personal debt) and has consistently caused asset bubbles whether in financial markets or property assets that have been followed by regular recessions. The problem with consumer led growth is that it is ultimately unsustainable because when peoples’ ability to borrow runs out or the cost of borrowing is raised then growth comes to an abrupt halt. Consumer led growth is a sign of a fundamentally weak economy where economic growth is not broad-based and therefore fails to regenerate and stimulate all sectors of an economy.

Fourthly, in spite of being the largest economy in the world, in the US there were 46.5 million people living in poverty or 15% of the US population in 2012. According to the US Census Bureau the US poverty rate has risen by 2.5 points since 2007, the year before the financial crisis and subsequent recession. The poverty rate among the young in the US was about 20%. Poverty stunts the development of the young, increases the susceptibility of the old to illness and impedes productive potential. Development, progress and advancement are fatally compromised. Hope and aspiration that come from continuous betterment in society are dashed so the future looks as bleak as the present. Thus today’s poverty perpetuates tomorrow’s.

The contraction in US growth in the first quarter of 2014 will be dismissed as a blip. However, as discussed there are structural flaws in the US economy that adversely affect its long run growth trajectory. The flaws transcend regular fluctuations in the business cycle and relate to how the US economy is structured and functions which therefore requires a root and branch reassessment of the economy’s workings. This discussion has not even broached the area of the US’s strategy position in the global economy and trade with the relative rise of China, Indian and the other countries in the BRICS although undoubtedly the US’s structural flaws are critically important in its ability to meet the economic challenge of these new emerging industrial nations. Unless the US is able reduce debt levels, increase industrial competitiveness, move to a model of broad-based economic growth and significantly reduce poverty levels, while economic growth may return, it will not be sustainable. Moreover the economic rise of competing nations relative to the US will continue appearing to suggest an acceleration in the long term economic decline of the US.