US senators will be debating the nation’s debt ceiling once again as the previous agreement in October 2021 was just a temporary extension. The last two years have seen two government shutdowns as senators voted along party lines and refused to give the government permission to take on more debt and increase America’s growing debt burden.

The US government debt position is extraordinary, it exceeds the nation’s GDP and raises serious questions on how the US can maintain its superpower status when she’s operating on borrowed money that all needs to be repaid.

Making Sense of America’s Debt

The national debt of any country is a measure of how much the government owes its creditors. In the case of the US the national debt is a term referring to the level of federal debt held by the public. Since the US government almost always spends more than it takes in, the national debt continues to balloon.

As the size of the debt grows, so do interest payments on that debt. This interest has a more immediate impact on government finances than the actual size of the total debt. In reality, in the modern era many nations never repay their debts. They roll their debt over, meaning they defer repayment endlessly, paying only interest on the debt. As long as they keep doing this, they remain solvent. Even if the state does not borrow more, the debt level gets steadily larger as interest accrues on the debt – but when the national economy is growing, the income for the government is also increasing, which can be used to repay the debt.

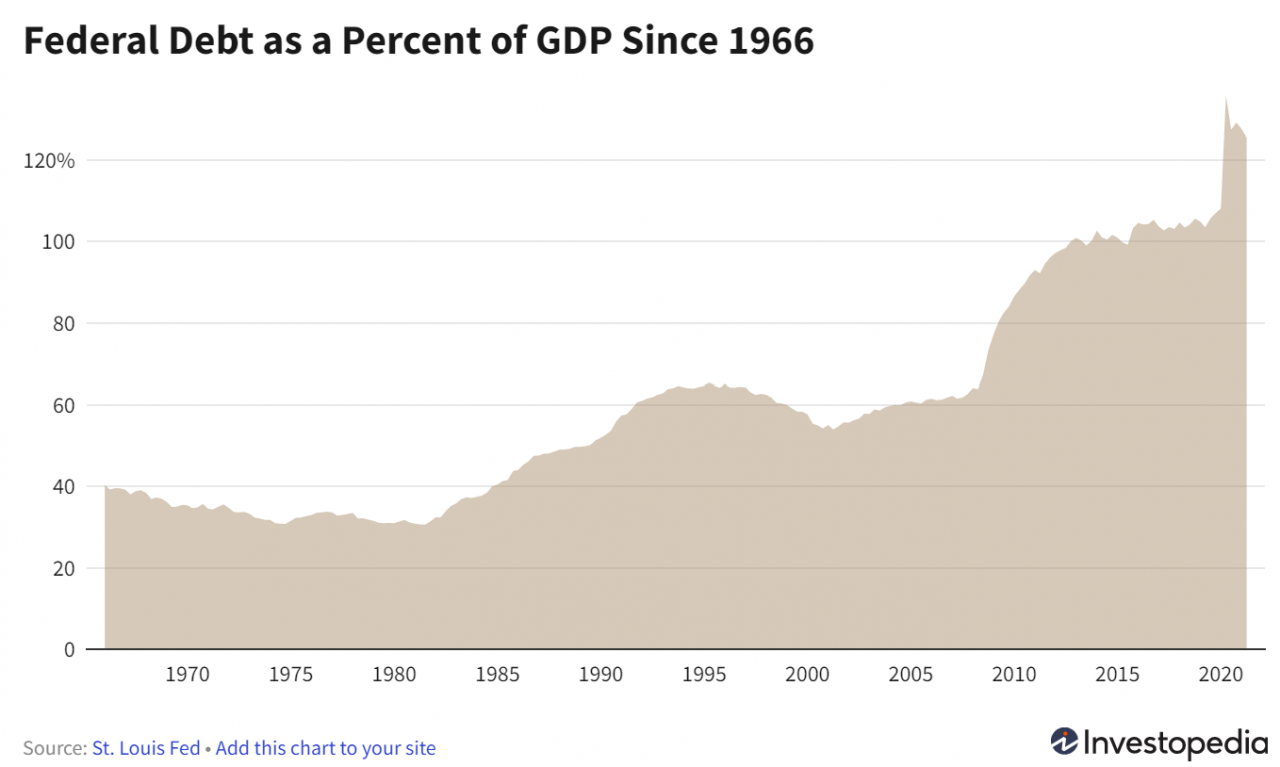

Although the national debt can be measured in trillions of dollars, it is measured as a percentage of gross domestic product (GDP), the debt-to-GDP ratio. That’s because as a country’s economy grows, the amount of revenue a government can use to pay its debts grows as well. As of the beginning of December 2021, the US national debt was a huge $29 trillion and growing.

The US’ larger economy has meant the country’s capital markets for now have continued to grow and the government can use them to issue more debt. This means that a country’s ability to pay off debt—and the effect that debt might have on the country’s economy—is dependent on how large the debt is as a proportion of the overall economy i.e. the debt burden in proportion to the income mountain, not on simply the dollar amount of the debt.

Some worry that excessive government debt levels can impact economic stability with ramifications for the strength of the currency in trade, economic growth, and unemployment.

A US default, no matter how quickly it is fixed, would lead to “complete chaos,” prompting investors to sell off an asset class that was considered risk free. Jacob Funk Kirkegaard, a senior fellow at the Peterson Institute for International Economics, believes that the damage to US credibility in global markets would be irreversible, Kirkegaard said, “If they miss a payment, that trust is gone: 250 years down the drain. And you don’t get that back just by promising, ‘Oh, I promise I won’t do it again.’ That’s not good enough for investors around the world.” The long-term effects of a default could also disrupt US foreign-policy tools, with a world less trusting of the US dollar making US financial sanctions less effective.

“If they miss a payment, that trust is gone: 250 years down the drain. And you don’t get that back just by promising, ‘Oh, I promise I won’t do it again.’ That’s not good enough for investors around the world.”

Some believe America’s debt is manageable and no cause for alarm. It is thought that although the US has substantial debt, unlike other nations it does not face the risk of default due to insolvency. Since World War II, the US has developed a unique status with its outsized military power and economic strength – this makes it difficult to draw conclusions about its debt based purely on the economic analyses of other countries. However, this does comes with a caveat – the US will undoubtedly experience other consequences if the increase in debt continues unabated. [1]

America’s Debt Mountain

America’s national debt falls into two categories: intragovernmental holdings and debt held by the public.

More than $22 trillion is debt held by the public while the remainder is intragovernmental holdings. Public held debt is debt a country owes to lenders outside of itself, a result of years of government leaders spending more than they take in via tax revenues. In capitalist economies, public debt allows governments to raise more funds to grow their economies or pay for services. [2]

Politicians prefer to raise public debt rather than raise taxes. It is considered a ‘safe’ way for people in other countries to invest in another country’s growth by buying government bonds i.e. debt sold on where the purchaser earns a fixed amount of interest every year for the duration of the bond.

However, when the national debt reaches 77% or more of gross domestic product (GDP) the debt begins to slow growth. America’s national debt in relation to the GDP stands at 132.84% today. [3] Indeed, Today’s economy, growing at a sluggish 1.6 percent per year, has been described using an old term inherited from the 1930s, “secular stagnation.”

As for the intragovernmental holdings, the Treasury owes this part of the debt to other federal agencies. Why would the government owe money to itself? Some agencies, like the Social Security Trust Fund, take in more revenue from taxes than they need. Rather than stick this cash under a giant mattress, these agencies invest in the US Treasury.

Foreign Owned Debt

Foreign governments hold a portion of the public debt in the form of government bonds, while the rest is owned by US banks and investors, the Federal Reserve, state and local governments, mutual funds, pensions funds, insurance companies, and savings bonds.

Currently foreign and international investors hold $7.3 trillion of the $23 trillion public debt.

Much has been made about China’s portion of the US foreign-owned debt. As the second-largest non-US holder of the Treasuries after Japan, some are worried that China could “call” the US loan, placing the US in dire financial straits. However, this doomsday scenario does not hold up to scrutiny although it does pose challenges for the US.

As of September 2021, the Asian nation owns just over $1 trillion of the national debt in Treasury securities. Many claim that China is able to leverage this against the US politically and China has done nothing to dissuade these claims. With tensions growing between China and Taiwan, political commentators from Beijing have openly stated that the US debt owned by China could be used as a financial weapon against America. This is simply not the case as China’s holdings of US debt in fact make it vulnerable to US pressure. US debt is in fact a Chinese problem as much as an American problem.

China is primarily a manufacturing hub and an export-driven economy. Trade data from the US Census Bureau shows that China has been running a big trade surplus with the US since 1985. This means that China sells more goods and services to the US than the US sells to China.

Chinese exporters receive US dollars for their goods sold to the US, but they need yuan to pay their workers and store money locally. They sell the dollars they receive through exports to get yuan, which increases the US dollar supply and raises the demand for yuan.

China's central bank, People’s Bank of China (PBOC), carried out active interventions to prevent this imbalance between the US dollar and yuan in local markets. It buys the available excess.

China must preserve access to the US market for exports. Representing a quarter of the world's GDP alone, the US is by far the world’s largest market for Chinese exports and China currently has no attractive alternatives to the American market. Multiple other investment destinations are available. With euro stockpiles, China can consider investing in European debt. Possibly, even US dollar stockpiles can be invested to obtain comparatively better returns from euro debt.

The US continues to play a dominant and unavoidable role in the global economy. In return for buying Chinese exports, the US has received relatively cheap imports and has been able to spend significantly beyond its means.

Ultimately, two major factors do not give China leverage over the US: its relative share in the US debt and the dollar’s position as the global reserve currency. China holds about 4% of the total outstanding US government debt and even if China decided to dump all its debt holdings all at once, it would a) not play as significant a role in harming the US economy as some imagine with a a small fraction of US reserves and b) the US dollar would still be considered one of the most safest, most reliable assets money can buy as it will remain an attraction proposition for many other buyers. As long as the US never defaults on its debt, there is little China can do to leverage its position in this regard.

Financing America's Debt

America’s national debt rises when the federal government spends more than it earns in tax revenues.

Some say that servicing the debt could divert investment from vital areas, such as infrastructure, education and healthcare. But President Biden officials have argued that these concerns are overblown and suggest that Washington still has decades to tackle the problem. They point out that the cost of financing the debt—in terms of interest payments as a proportion of GDP—has been relatively low over the past two decades, though it will increase over time. Moreover, they have argued that the United States should take advantage of the current low interest rates to invest in infrastructure, climate efforts and the social safety net.

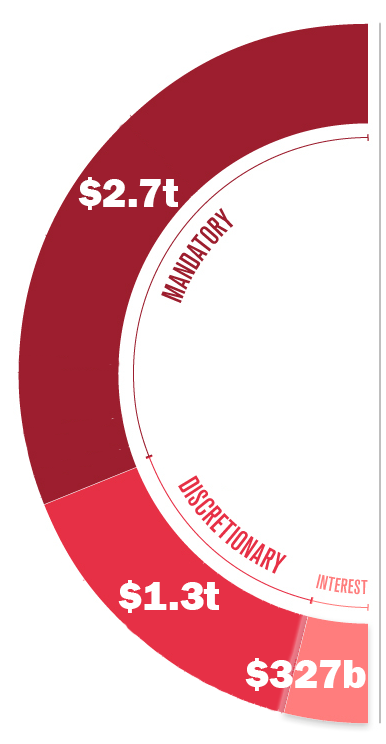

It is true that the interest expense owed on US debt does not comprise a large portion of the budget — in 2019 net interest payments on the debt were 8.7% of all federal outlays ($327 billion). By comparison, debt service was more than 15% of federal outlays in the mid-1990s. The share has fallen partly because lower rates have held down interest payments, but also because outlays have risen substantially, up about 29% over the past decade. [6]

Although insolvency isn’t an immediate danger as things are, there are other implications such as a US credit rating downgrade by credit agencies if the political parties in Washington prevent the US debt ceiling from being raised to make its payment. Alarmingly for the US, increasing interest expense has another major budgetary consequence, even if it can be adequately and fully funded every year.

Defense Budget

The budget for the federal government covers three main areas: mandatory spending, discretionary spending and net interest expense.

While an increase in interest payments do not seem to put the US in any danger of defaulting, the real concern for Washington is when rising interest expenses have to be covered from other areas of the budget — this will be from the discretionary spend.

Mandatory spending includes pre-existing obligations like Social Security, Medicare and income security programs. The discretionary budget, on the other hand, requires passing annual appropriation bills and is composed of defence spending.

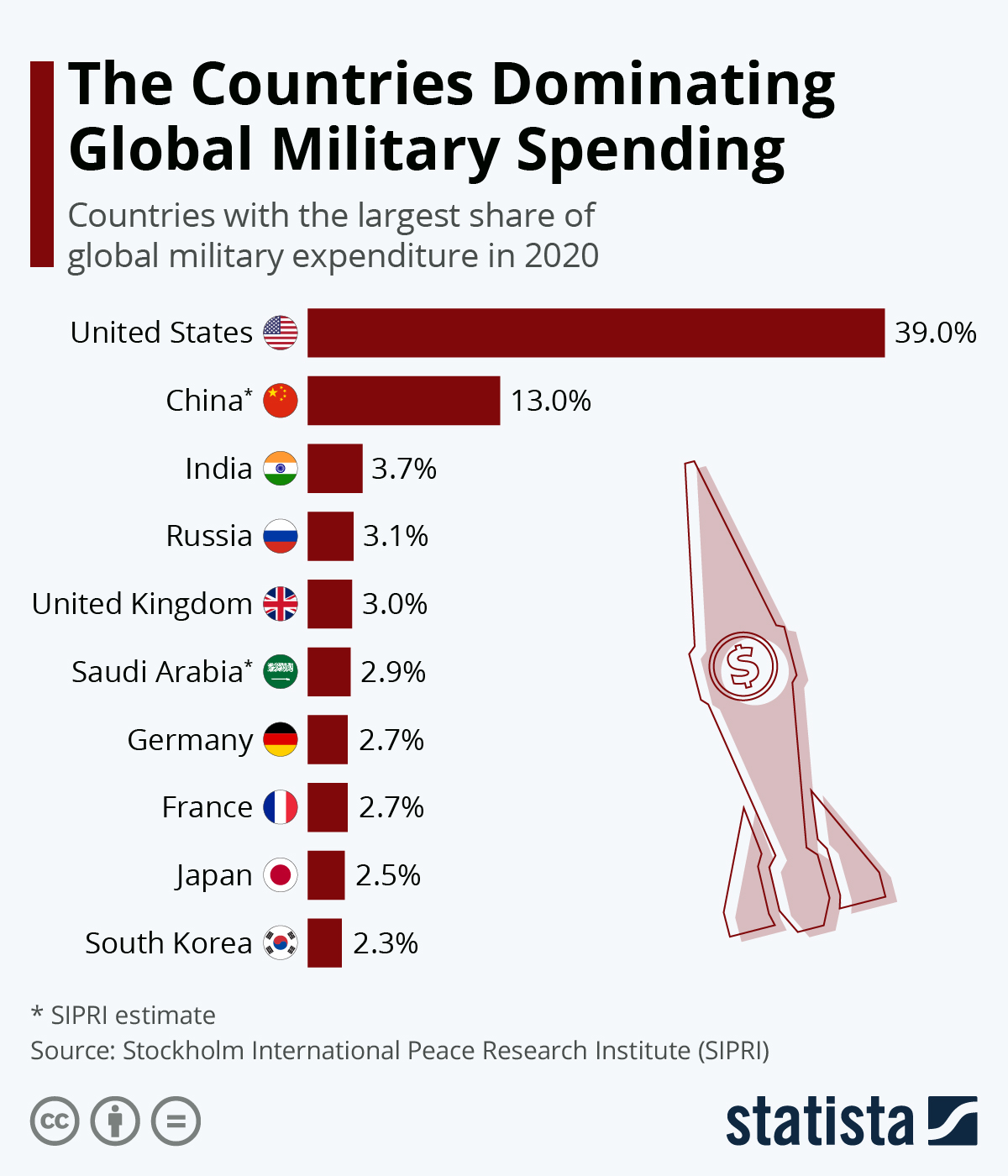

The US led the ranking of countries with highest military spending in 2020, with $778 billion dedicated to the military. That constituted two-fifths of global military spending that year. Astonishingly, as of 2019, the US military expenditure amounted to only 3.4% of US gross GDP, placing the US lower in the ranking of military expenditure as a percentage of GDP than Saudi Arabia, Israel, and Russia. [7]

The outlays for defence is expected to rise from a low of 596 billion US dollars in 2014, to 915 billion US dollars by 2031, according to the US Congressional Budget Office (CBO). The largest parts of the budget are dedicated to the Navy and the Air Force.

If interest rates exceed the CBO’s current projections, it is very likely that defense spending will suffer. The US is a global power with global interests, it desires to remain capable of engaging in more than one theatre at any time. The US finds itself increasingly challenged by competitors such as China and Russia and the effects of COVID-19 affected military services in ways that were similar to the how it affected the population generally. Training was curtailed, exercises with allies cancelled or reduced in scope and military resources were redirected to support civilian efforts in tackling the pandemic. The situation took a toll on some aspects of readiness across the force.

Conclusions

The US is in a unique position where rising debt will not place it in a critical position and in some regard, has even worked in its favour.

China, the largest foreign owner of US dollar reserves, is overdependent on the export-market and will not be keen to damage an economy while it is threatened with civil unrest domestically. China will continue to keep the yuan cheap relative to the dollar. Even if China looks for alternatives to the US dollar, there are very few options that carry less risk than the assets of the United States. The Eurozone risks dissolution and Russia’s fragile economy is overdependent on oil. Japan faces low growth for the foreseeable future and India remains a low-income country with non-performing loans.

The dollar remains the global reserve currency. Selling off US reserves by any nation will only allow the US to reliably repay back its debt with cheaper dollars - a political advantage that is not afforded to other indebted nations. As long as the US can increase taxes and use wealth assets to generate more revenue, it should remain in a strong position to continue to pay its interest obligations and increase its discretionary spending towards the military to project its global strength well into the 21st century.

Historically, the US has managed to swing public opinion to increase revenue using patriotic initiatives when pressured geopolitically, regardless of the political party in office at the time. To a degree that will surprise many, the US funded its World War II effort largely by raising taxes through “war bonds”, Hollywood propaganda circuits across the country and tapping into Americans' personal savings. Although WWII does not provide the best case for massive fiscal stimulus today, it demonstrates the resilience of the US economic machine to finance its global objectives - even with the highest debt on earth.

[1] The U.S. National Debt Explained: History and Costs (investopedia.com)

[2] Who Owns the US National Debt? (thebalance.com)

[3] U.S.: National debt in relation to GDP 2026 | Statista

[6] 5 facts about the national debt | Pew Research Center

[7] Ranking: military spending by country 2020 | Statista

[8] Introduction: An Assessment of U.S. Military Power | The Heritage Foundation

[9] US household wealth surged $20tn despite the pandemic | Article | ING Think